The Form 26AS (Annual Tax Statement) is divided into three parts, namely Part A, B and C as under: Users of can view tax credit in form 26AS through Bank Login : Users having PAN number registered with their Home branch can avail the facility of online view of tax credit in Form 26AS.

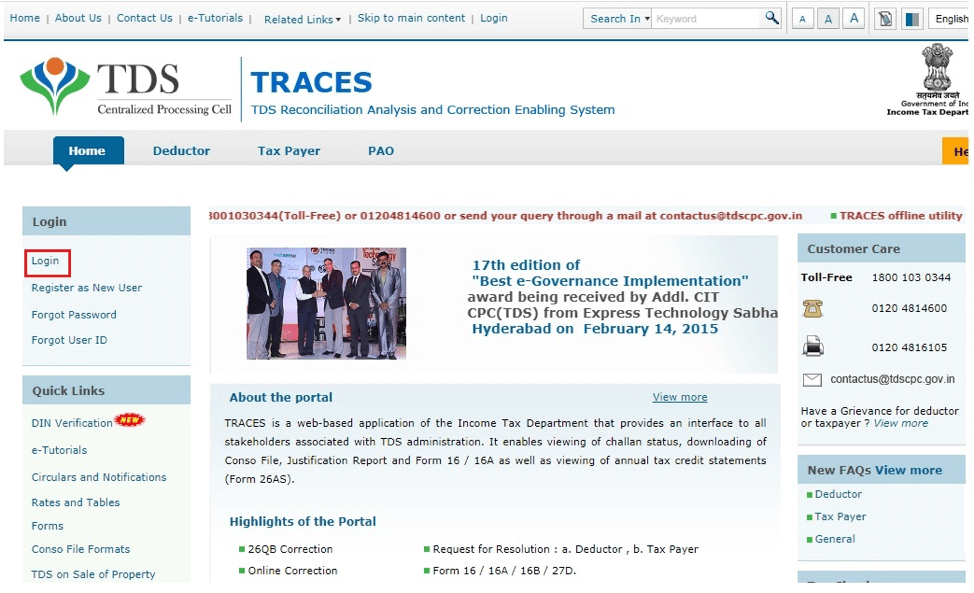

To download Form 26AS from TRACES website, you need to login with your user ID and password and follow these steps How to Download 26AS from Traces through TDS CPC website ?

Select the ‘Assessment Year’ and ‘View type’ (HTML, Text or PDF) View the disclaimer ⇒ Click ‘Confirm’ ⇒ Agree the acceptance of usage ⇒ Click ‘Proceed’ Go to the ‘efile ‘ menu located at upper-left side of the page ⇒ Click Income Tax Return : then Click ‘View Form 26 AS ‘ , User is redirected to TDS-CPC Portal Perform the following steps to view or download the form: How to Download 26AS from Traces through Income Tax Department website ? This statement is presented yearly, which reflects the transaction of the concerned year. Information received from various agencies on high value transaction carried by self.Refund issued by the Department to self.Tax paid through Tax Deducted at Source (TDS) or TCS on behalf of users own presence.Advance tax, Self-Assessment Tax and Regular Assessment Tax paid by self.The following details have been provided in 26AS statement:

0 kommentar(er)

0 kommentar(er)